If an employee is earning $60,000 and is paid on a monthly basis, their gross monthly pay will therefore be $5000. To calculate gross pay for hourly workers, multiply the hourly rate by the hours worked during a pay period. For example, a part-time employee who works 35 hours at $12 per hour will have a gross pay of $420. Commissioned employees are those who receive a percentage of the profits from their sales. Wage calculations for this kind of employee can be more complicated than for salary or hourly employees since their gross pay will vary depending on the number of sales they make. To calculate the gross pay for a commissioned employee, employers must add up all of their commissions from the period and subtract any deductions that need to be made.

Who pays, and doesn’t pay, federal income taxes in the U.S.? – Pew Research Center

Who pays, and doesn’t pay, federal income taxes in the U.S.?.

Posted: Tue, 18 Apr 2023 07:00:00 GMT [source]

Many employees aspire to increase net pay throughout their careers and over time. This is most often accomplished through salary negotiations, promotions, or changing roles and companies. Gross pay and net pay are two essential concepts for employee satisfaction and business compliance.

Calculating gross vs. net income

After voluntary deductions and any taxes are accounted for, all that’s left to figure out are mandatory payroll deductions. Voluntary deductions are any deductions that an employee chooses to withhold from their paycheck that are not required by law. They’re referred to as “pre-tax” because they are removed before taxes are calculated and, thus, reduce taxable income. Net pay is what happens to an employee’s income after all gross pay deductions have been taken out. It doesn’t matter if we’re talking about hourly gross vs. net pay or gross vs. net salary; in the case of any income type, the basic principles of gross or net remain the same.

- Using global payroll services like a PEO or an EOR can help simplify the process of paying distributed employees.

- We’ll use this article to explain the difference between the gross pay and net pay of an employee.

- Paychecks or pay statements report the income attributable to a given pay period.

- First, we need to figure out the gross pay of the employee because all the deductions will be done from this amount.

Before we wrap this post up, let’s summarize the difference between gross and net pay. With his help, the process of calculating his net pay becomes relatively easy. Federal taxes remain constant for all individuals working within the United States, but exactly how you pay them may differ depending on your exact employment situation. If you have any questions about who is eligible for overtime pay, take a look through our Exempt vs. Non-Exempt Employee post.

Put Local Payroll Vendors in the Rear-View Mirror

There are several reasons why you should be aware of gross pay and a few ways that it comes in handy. A full-time human resources employee or outsourced HR service should be prepared to answer any questions about payroll deductions and offer information and guidance regarding benefit options. Calculating gross pay differs depending on whether the employee is salaried or hourly.

- This simply means that the employer pays a percentage of these taxes on behalf of the employee.

- Your entire gross salary is taxable, but all payroll processes need to include the gross pay to specify what the employee earned before any dedications were made.

- It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.

- To find an hourly employee’s gross wages, multiply their hourly rate by the number of hours worked during the pay period.

In some cases, an employee may have other mandatory payroll deductions called wage garnishments. It includes child support payments, delinquent student loans, unpaid taxes, and credit card debt. If that’s the case, the employer can withhold a specific amount from each paycheck. When you prepare payroll for employees, you’ll need both net salary and gross pay on the payslip.

Gross Pay Vs. Net Pay: What’s the Difference?

Marketplace gives you access to projects at top companies who value independent talent. Build your business by finding projects that meet your needs and creating long-term relationships with clients who can easily re-engage your services. In any event, there is one bright side to the gross vs net pay equation. And from Quickbooks integration to automatic union timecard calculation, Wrapbook is constantly looking for ways to innovate and improve its already superior products and services. In film production, that contract is usually activated as a crew deal memo, but it’s form and language will change from situation to situation or industry to industry. Sign up for the Wrapbook monthly newsletter where we share industry news along with must-know guides for producers.

If an employee is unsure about taxes and other deductions being made from pay, they should seek quick clarification from HR or payroll leads. Net pay will therefore be lower than gross pay with the exact percentage difference depending on your country’s tax regime, your salary level, and your wider personal circumstances. Companies, contractors and employees with other income sources beyond their main employment will also have to think about gross income vs net income. In practice, some individuals may have more straightforward or more complex situations than others. However, workers can still take advantage of pre-tax deductions, even if they’re paid via 1099.

How to Calculate Gross Pay?

There are also post-tax deductions, which are sometimes taken from your net pay or after the taxes have been applied, such as union fees or charity donations. Payroll registers show you the total gross wages your business pays during a period. And, they show you how much you withheld for taxes and other deductions. The net pay listed on the payroll register shows you how much you paid employees through direct deposit, check, or cash. Payroll registers include information about individual employees, similar to pay stubs.

This guide is intended to be used as a starting point in analyzing an employer’s payroll obligations and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. Employees can consult pay stubs if they have concerns about the difference between gross and net pay.

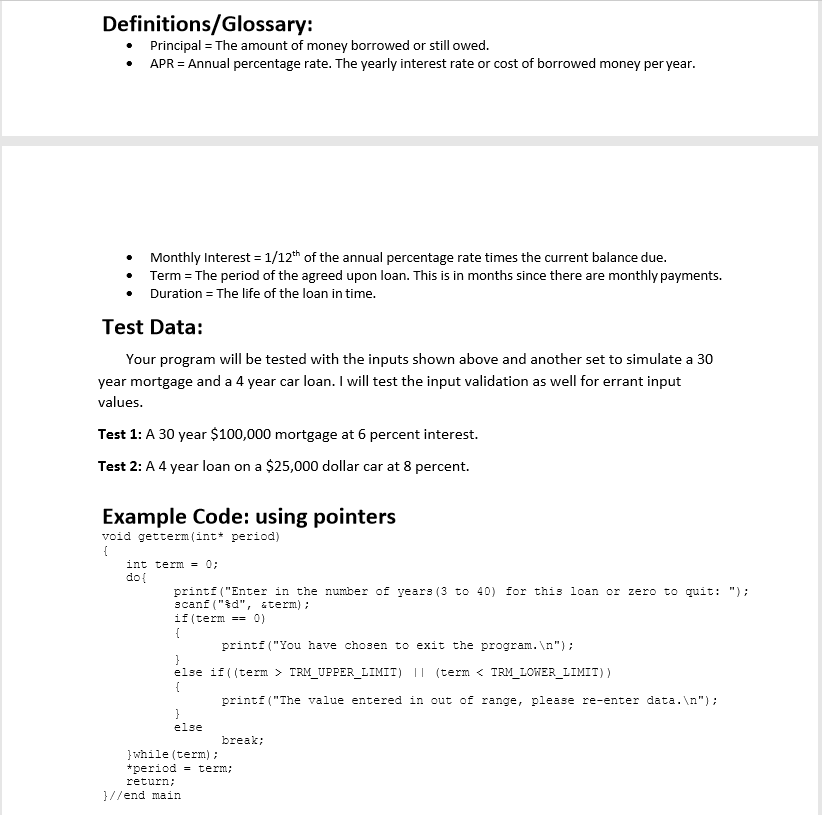

A common challenge is understanding net pay and gross pay—what the differences are and how to calculate each in different jurisdictions. The person works 40 hours per week, so the standard full-time work week. In short, gross pay refers to the total amount an employee earns before any deductions or taxes. In contrast, net pay is the amount an employee receives after all deductions, such as taxes and other benefits, are taken out. Using automated payroll software can help you streamline your payroll process.

Net pay is a worker’s total take-home pay, or what’s left after payroll taxes and deductions are taken out. Some common deductions include FICA payroll taxes, income tax withholdings, health insurance, and retirement contributions. Some deductions are mandatory, while others are at the request of the employee.

However, a payroll register is a record of payroll details for all your employees. Payroll registers are for your records, not for distribution to employees. Pay stubs list details about each employee’s pay, including their gross wages, deductions, and net wages. Payroll Gross pay vs net pay providers can help automate these manual processes to ensure calculations are accurate each payday. With tax compliance experts on staff, all-in-one workforce management platforms help employers avoid potential payroll and tax errors while mitigating legal risks.

Barbie Movie Box Office: Every Record Broken So Far – The Direct

Barbie Movie Box Office: Every Record Broken So Far.

Posted: Sat, 19 Aug 2023 07:00:00 GMT [source]

They depend on the agreement you have with your employer and are usually part of your employment contract. While the term is usually used in the context of employees, it is also sometimes used when talking about paying independent contractors. At Wrapbook, we pride ourselves on providing outstanding free resources to producers and their crews, but this post is for informational purposes only as of the date above. The content on our website is not intended to provide and should not be relied on for legal, accounting, or tax advice. You should consult with your own legal, accounting, or tax advisors to determine how this general information may apply to your specific circumstances.

These taxes are not mandatory, but it helps lower the employee’s taxable income. It includes retirement contributions, health benefits, life insurance premiums, etc. Gross pay will likely always be more than net pay because net pay includes deductions from gross pay. Gross is an employee’s total earnings, such as wages or salary, while net pay is their earnings minus payroll deductions, including taxes, benefits and garnishments. And, you must know the employee’s gross wages to determine their tax liability. That is the amount of money you make before any deductions are taken out.